|

While the PDF format is the most suitable format for certain content on your website (i.e. instruction booklets, technical data sheets, white papers, etc.), the format is really not the best one for SEO optimization.

Today’s search engines can scan PDF documents (whereas a few years ago they did not), but they are not as optimal as HTML content pages. That being said, if you have to have PDF pages on your website, there are several things you can do to ensure they help you on the SEO front (or at least don’t hurt you) as much as possible.

0 Comments

At the heart of your company’s digital strategy should be a well-designed, easily navigable, engaging website that meets the needs of your customers and other business stakeholders alike. What is required to satisfy these criteria can shift over time, and, unfortunately many companies have a “Create it and Forget it” mentality when it comes to their website. Like any of our marketing materials, after a while a website begins to look stale. However, if the core functionality of your website is working desirably, you may not need a costly rebuild, and often can choose to re-skin your site instead and achieve the desired effect. A re-skin is a quick way to improve a poorly perceived user experience. It primarily involves updating the appearance with new graphics, layouts and styling to give it a new look and feel. From a marketing perspective, it helps promote a stronger or renewed positive emotional response and connection to your brand. With that said, here are some of the more common reasons to have your website re-skinned: 1.) Your brand positioning or key messaging has changed; 2.) You have introduced new services or updated your offering; 3.) The effectiveness of your current site is diminishing; 4.) Your visitors are not sticking around; 5.) Your website just looks outdated and/or unprofessional. When planning for a re-skin you should always start by asking yourself what you hope to achieve by re-skinning your site. This often highlights any issues such as poor navigation, page flow, content and features, which can be addressed during a subsequent rebuild.

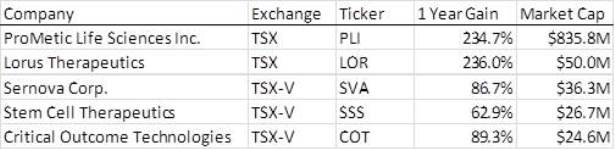

From the mid-1990’s to the mid-2000’s, U.S. and Canadian biotech stocks were essentially neck and neck. Then Canada got crushed by the long nuclear winter that began in 2007 and the U.S. traded sideways until 2011. Now, the biotech space in the U.S. is hot, with the U.S. Biotech Index (NBI) breaking out of a multi-year base to all-time highs last year. But what about the biotech space in Canada? Are investors interested? Until recently, Canadian investors obsessed over the quick returns of the mining sector boom and certainly favoured precious metal stocks over biotech stories. As the market sentiment for mining and resources having cooled, investor attentions appear to be returning to the life sciences space. Here is just a small sampling of Canadian life sciences companies and the year-over-year returns investor have realized: Obviously only time will tell if the Canadian life sciences space will be able to catch up to the similar space in the U.S. But for those investors who understand life sciences, there may well be some very handsome returns to be had. However, the rather long investment horizon means that investors should educate themselves on the product, the timelines, and the regulatory process involved.

Taking the time to understand who your shareholders (or other investors) are, what their needs may be, and why they invested in or bought your stock puts you in a stronger position to get their attention when you are looking for support, whether in the form of needing to raise more funding or in the form of a shareholders vote. This will establish a strong business/investor relationship and creates an environment of trust and comfort for mutual success.

Don’t just communicate with your investors when you need something from them. Keeping an open dialogue, or at least an open door, ensures that your investors are as up to date on the company as they want to be, and further strengthens the relationship. If you have some shareholders that you haven’t seen in a while, or that you have only seen when you need money from them, it may be worth your while to go and meet with them. Provide them with an update on the business and see if they have any questions or concerns that you can address. Putting in the time to maintain and strengthen an investor relationship can be, and often is, the difference between keeping a long term supporter or not. Over the weekend, our client, Critical Outcome Technologies, surpassed 1,000 followers on Twitter. For a small biotech company in Canada, this is further validation that the company has an interesting story and mission. For Heisler Communications it is further validation of the importance of using social media to help small companies gain more visibility in the markets. Since the beginning of this past summer, Critical Outcome Technologies has been using multiple social channels to communicate with investors, potential business partners and other stakeholders. In addition to Twitter, we have helped the Company build a larger, targeted following via the Critical Outcome Blog, SlideShare, YouTube and Facebook.

There are many reasons why a public company should have a corporate / investor relations blog. Yet, many companies simply don’t have one – for various reasons. One of the most frequent reasons given, is that management is worried that they won’t have enough content for keeping their blog up to date, relevant, and blog worthy. That raises the question of how often should you post new content to your blog? While the short answer is there are no hard and fast blog post rules, the answer really comes down to as often as you can create quality content. In this post, we wanted to share just one great way that you can increase the frequency of adding great new content to your blog.

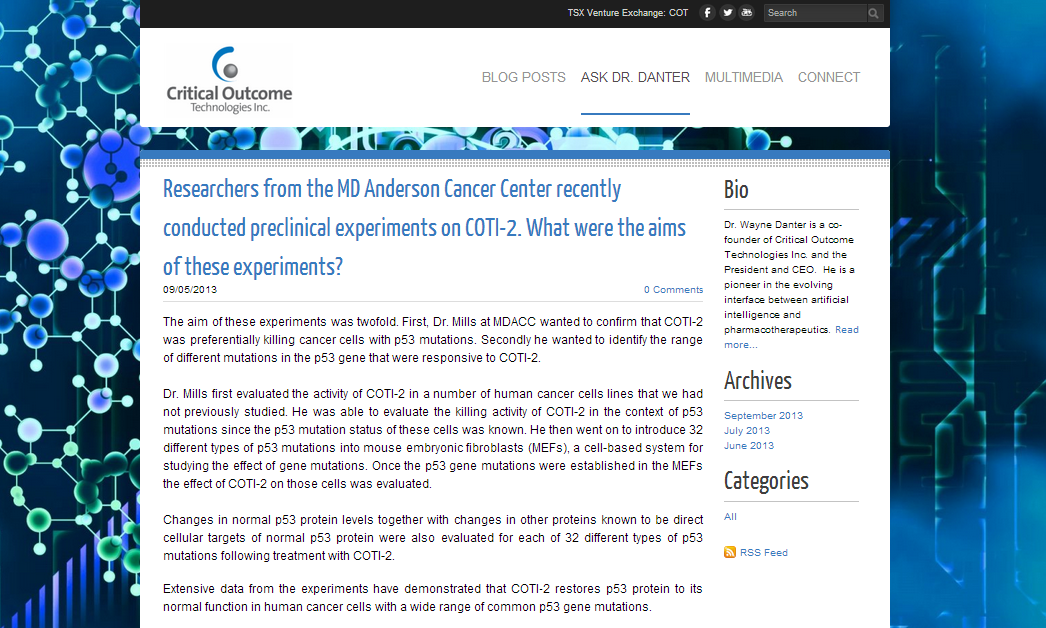

Like most public companies, you most likely receive inquiries from investors asking either about various elements of your business or for clarification on something you have previously disclosed. Why not use your blog to share answers to these questions posed by investors and other stakeholders? In other words, make use of investor inquiries to fuel your blog postings. Keeping in mind that the person asking the question may not want their identity and/or contact information shared, simply don’t include it. Also, you may want to wordsmith the question (and the response) to tie it back into your core messaging. Our client, Critical Outcome Technologies, uses its blog to provide answers to questions from investors on its ‘Ask Dr. Danter’ page (see below). If you post answers to questions regularly, you will not only have more frequent blog content, but you will also have a database of answers – creating a valuable resource for investors and other stakeholders. This can be a great time saver if you find yourself being asked similar questions time and again by phone or email. Simply point these people to the blog where they can find all of the answers and other great content about your company. Last week, Critical Outcome Technologies (TSX-V: COT) issued a news release with what was not only a material announcement, but promising news in the fight against cancer. As a micro cap life sciences company listed on the TSX Venture, its news did not garner coverage from any of the traditional media outlets in Canada. While the story was shared on a few online news portals and the Wall Street Analyst, it was social media that ensured the story got noticed.

In mid-June, based on their early progress in using social media for investor communications, Critical Outcome Technologies launched an investor relations blog called the Critical Outcome Blog. The blog features a landing page with introductions about the company, including a YouTube video embed and a SlideShare embed. The blog site has separate sections for blog posts, multimedia, and a page where the company's founder, Dr. Wayne Danter, will provide answers on subjects ranging from the company's business, to drug discovery and development, and other relevant industry news.

Between Twitter, Facebook, SlideShare, YouTube and now an IR blog, Critical Outcome provides investors with many avenues to research the company, receive the latest updates and additional context around the company's business and industry, and provide feedback to the company. Back to Part 1. How one micro cap is using social media for investor relations and attracting new audiences6/6/2013 If planned and implemented correctly, social media communications as part of your overall investor relations program can be an effective and inexpensive way for attracting new audiences to your investment story. Social media helps level the playing field for smaller public companies, offering a cost-effective opportunity to build deeper relationships with investors and other investment community stakeholders by facilitating interaction and feedback. The following is a snapshot of Critical Outcome Technologies' use of social media for investor relations and attracting new audiences.

When looking at Critical Outcome's followers on Twitter, it is interesting to notice how targeted the audiences appear to be. A very high proportion of the company's Twitter followers are either identified as investors (brokers, traders, VC or bankers), life sciences companies, doctors, researchers and/or cancer centers - all very relevant groups for this company.

Given the (on average) more affluent and educated masses on LinkedIn compared to Twitter and Facebook, and the fact that LinkedIn appears to be the preferred social networking site of registered investment advisors, it would appear that LinkedIn should be a prime target for IROs. However, we have not seen LinkedIn being used to the same effect as Twitter and even Facebook for public companies’ investor relations.

So the question becomes, how can a company use LinkedIn as an investor relations tool? Here are just a few ideas to get started:

We have all heard the old adage, "it's not what you know, it's who you know that counts." In today’s age of social media and social networks like Facebook, Twitter, LinkedIn and others, many online networkers seem obsessed with how many friends, followers and connections they are able to show on their social media profiles. However, I am sure most would agree that “who you know” is far more relevant than “how many you know”. I would much prefer to be a part of a small but highly engaged network of professionals rather than having a “network” of hundreds or even thousands of people I don’t know.

The bottom line here: People with strong networks get more things done more effectively than people with large, loose networks with little in the form of member engagement. Remember, to keep your network engaged, keep your connections up-to-date. Let your network know what you’ve been doing lately and have planned for the near term. Status updates on Facebook, Twitter and LinkedIn are great for this. |

AboutWelcome to our blog. We will use this space to discuss and promote evolving best practices in the fields of public relations and financial marketing. Archives

February 2017

Categories

All

|

RSS Feed

RSS Feed