|

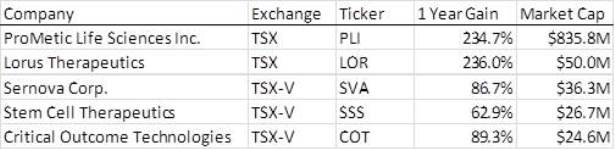

From the mid-1990’s to the mid-2000’s, U.S. and Canadian biotech stocks were essentially neck and neck. Then Canada got crushed by the long nuclear winter that began in 2007 and the U.S. traded sideways until 2011. Now, the biotech space in the U.S. is hot, with the U.S. Biotech Index (NBI) breaking out of a multi-year base to all-time highs last year. But what about the biotech space in Canada? Are investors interested? Until recently, Canadian investors obsessed over the quick returns of the mining sector boom and certainly favoured precious metal stocks over biotech stories. As the market sentiment for mining and resources having cooled, investor attentions appear to be returning to the life sciences space. Here is just a small sampling of Canadian life sciences companies and the year-over-year returns investor have realized: Obviously only time will tell if the Canadian life sciences space will be able to catch up to the similar space in the U.S. But for those investors who understand life sciences, there may well be some very handsome returns to be had. However, the rather long investment horizon means that investors should educate themselves on the product, the timelines, and the regulatory process involved.

5 Comments

John Bailey

2/26/2014 11:24:15 pm

Canadian investors have been shy of biotech for some time and it has certainly been a difficult road for biotech companies listed here. But perhaps the climate is improving.

Reply

Ryan Skinner

3/3/2014 11:11:38 pm

Interesting list of companies and returns. I notice your firm handles investor relations for Critical Outcome. Who would you say their comparables are?

Reply

rfljackson

3/3/2014 11:17:00 pm

Cormark Securities published (February 27th) a 26 page report on Lorus Therapeutics giving it a BUY recommendations with a 12 month Target Price of $1.60.

Reply

rfljackson

3/3/2014 11:27:29 pm

Hopefully Lorus stock has support at this level and we can go on from here. Seeing more new buyers every day. It's about time!

Reply

Trevor Heisler

3/3/2014 11:47:26 pm

Interesting question Ryan. As far as a comparable for Critical Outcome (COT) in terms of their drug pipeline, I would say Lorus Therapeutics is a good one. However, looking at COT's drug discovery technology, which is their core competence, I would compare them to Compugen (NASDAQ: CGEN), realizing that COT is a smaller, Canadian-based company.

Reply

Leave a Reply. |

AboutWelcome to our blog. We will use this space to discuss and promote evolving best practices in the fields of public relations and financial marketing. Archives

February 2017

Categories

All

|

RSS Feed

RSS Feed